Understanding Liquid Staking: A Comprehensive Guide

Liquid staking offers a new way to use assets in the crypto world. It reshapes what users can do. A liquidity pool lets DeFi investors earn rewards without locking their assets. This method lets one oversee their holdings and earn passive income. Below, we delve into the mechanics of how this works.

What is Liquid Staking?

One of the main problems of classic staking can safely be called the freezing of assets. The Proof of Stake mechanism requires users to lock their assets. This ensures system stability. Liquid staking solves this problem by allowing cryptocurrency holders to bypass these restrictions.

In essence, liquid staking represents the next evolutionary stage of classic staking. It maintains reliability while offering new opportunities to blockchain users.

Importance of Liquid Staking in the DeFi Ecosystem

Classic staking serves as a system stabilization tool due to frozen assets. This system has proven effective, yet it has limitations. Cryptocurrency owners cannot use their coins while they are locked for stabilization. This greatly limits investment variability for holders.

Іs staking crypto worth it? Liquid staking aims to change the rules and grant cryptocurrency holders more freedom. You no longer need to freeze your assets and leave them idle—you can utilize them for trades. This flexibility is valuable. It lets you use your staking tokens without giving up the chance to earn staking rewards.

How Liquid Staking Works

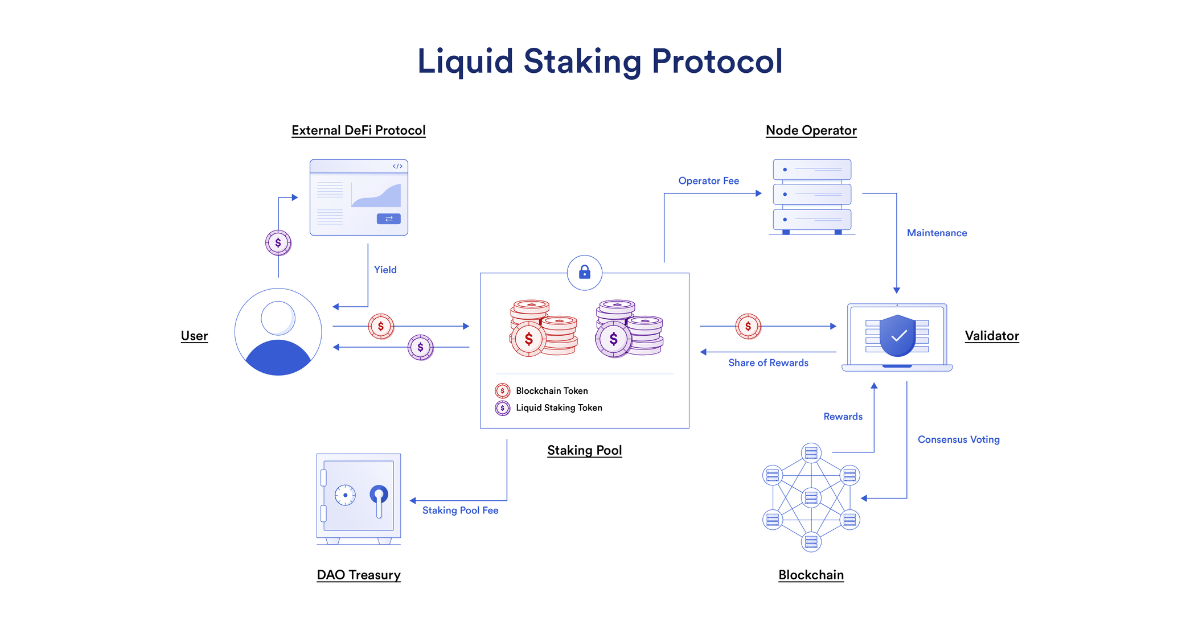

We've discussed the concept of liquid staking, but you may wonder how this system operates. The mechanics are both simple and complex. The principles of liquid staking can be summarized as follows:

-

Cryptocurrency escrow. Users deposit their crypto with a liquid staking provider. This is instead of directly staking through a validator node.

-

Validator management. The liquid staking provider handles technical tasks. It selects and manages validator nodes.

-

Receiving liquid derivatives. In return, users get liquid staking tokens. These are the LP tokens that represent their staked assets.

-

Token value growth. Liquid derivatives appreciate in value based on the staking rewards received.

-

Smart contracts. This core tech of liquid staking ensures security, automation, and speed.

-

Preservation of asset liquidity. Users can stake their assets and keep them liquid. This allows continued use of the assets.

Liquid derivatives let the token holder manage their balance. They can also benefit from staking.

Benefits of Liquid Staking

As liquid staking is a relatively new technology, many users are curious about its merits. Despite being progressive, most cryptocurrency owners do not want to risk their wealth. Thus, we’ve thoroughly analyzed the advantages of liquid staking.

Enhanced Liquidity

Liquid staking offers previously unavailable opportunities. If you ever had to freeze your assets to ensure the stability of the system and earn rewards—forget those times. Liquid staking lets you use liquid assets for trading, not your coins.

Flexibility and Accessibility

With liquid staking, users are afforded a much greater sense of freedom. No longer must assets remain locked away for extended durations. This evolution in staking makes it more approachable. It also appeals to a wider audience. Liquid staking tokens have been increasingly available in many DeFi protocols. With this, it opens a wide avenue for the user in terms of investment and management in digital wealth.

Higher Potential Returns

Liquid staking allows users to passively earn more on top of the regular rewards, and liquid staking tokens can be used across various decentralized finance (DeFi) protocols for more capital growth and padding up profits.

Risks and Considerations

Coming with such advantages, liquid staking-as any other technology-also features some downsides. It is pretty important to weigh these factors against one another before one dives into liquid staking.

Smart Contract Risks

Liquid staking relies on options for smart contract options. They ensure automation and security at the same time. However, they are not absolutely safe either. Bugs or vulnerabilities of smart contract coding may result in losses of funds.

Market Volatility

Like all cryptocurrency assets, liquid derivatives face market volatility risks. The prices of assets used for staking can fluctuate greatly. This affects the value of liquid staking tokens.

Regulatory Factors

Liquid staking must comply with regulatory requirements that can differ by jurisdiction. As crypto regulations evolve, users should watch for legal changes. They could affect the availability or terms of staking.

Case Studies and Success Stories

In theory, everything doesn't really amount to much without practice. So we decided to look into how all these things can be applied in the real world through liquid staking means. We weren't searching very long because of the high interest in this technology. Then, we pointed to one example that was pretty crystal clear: the Lido protocol.

Real-World Examples of Liquid Staking

Lido is a top decentralized liquid staking protocol on Ethereum. It lets users stake ETH easily, without complex technical requirements. The total value locked (TVL) on the crypto staking platforms exceeds $23 billion as of August 8, 2024.

Lido's main advantage is its liquid staking token (stETH). Users can trade it on DEXs instead of a direct stake. The protocol uses a decentralized network of node operators. This ensures reliable Ethereum block validation. The system rewards users with extra stETH. This increases the value of their assets through time.

Lido operates as a DAO: Users can thus say their word in its further development. Moreover, Lido never keeps any user ETH; full control over one's assets is granted. What adds to its utility is that stETH is integrated into many popular defi ecosystems. More recently, Lido extended liquid staking to a layer 2 solution: Wrapped stETH, or wstETH, is faster and cheaper.

Lessons from Successful Investors

Thus, great investors actually succeed due to profound knowledge, discipline, and effective principles that work. Among the things that have been learned over time by investors is the margin of diversification. Investors like Warren Buffett have stressed one thing: Never put all your money in a single asset; rather, spread the risk across classes.

Liquid staking and DeFi solutions help with that. One can manage the assets while still reaping the staking rewards.

Conclusion

Liquid staking is a fresh concept in the blockchain space. Unlike traditional staking, this method does not require you to freeze your assets. Instead, you receive liquid staking crypto that enables you to continue your investments.

The use of smart contracts underpins the operation of liquid staking. However, they can also present weaknesses, as not all contracts are fully secure. Before choosing a platform, please research its liquid staking terms and offerings.

FAQ

How does liquid staking work?

◄

The initial stage of this mechanism is the same as always, you give away your tokens to stabilize the system. However, there is an important detail. In return, users get a liquid staking token. It can rise in value as they earn staking rewards.

What are the advantages of liquid staking?

◄

Liquid staking is a way to keep your assets in a liquid state. Users can trade or utilize liquid tokens in various DeFi staking protocols. Besides these features, another advantage is that users keep earning staking rewards consistently.

Can I withdraw my staking assets at any time?

◄

Of course, but you don't have to withdraw your tokens to trade and earn. You can use the assets received in exchange to enter into deals while retaining the right to the reward.

How does liquid staking differ from traditional staking?

◄

It's a difference in capabilities. Classic staking takes everything from you to create platform stability. In addition to rewards, liquid staking offers liquid coins, which you can use without losing benefits.

What is DeFi?

◄

Decentralized finance is like an old banking system that won't cheat you. Here, you can use all assets and receive benefits. The best crypto staking platforms let users engage via smart contracts, boosting transparency, accessibility, and control over assets.

What is a smart contract?

◄

Decentralized finance smart contracts are like the magic wand of a sorcerer, performing automation with precision. It allows users to perform transactions and tasks without third-party intervention. However, security is a key consideration when trusting it with anything valuable.

What is staking?

◄

Staking, in the traditional sense, is a simple scheme: you give up your coins to help stabilize the network. The frozen coins prevent token value from dropping, ensuring system stability. In return, you receive a reward.

What is a liquidity pool?

◄

A liquidity pool is like a bank of coins where you add tokens for the benefit of others. Liquidity pools are essential. They create security and functionality for the entire system. Without them, the system would be unstable, and users would lose opportunities.

What is market volatility?

◄

Market volatility refers to how much a token's value can change over time and how that affects its owner. Lower volatility means your tokens are less likely to lose value suddenly.

What is liquid staking?

◄

Liquid staking lets DeFi users earn rewards without losing the ability to trade. Unlike traditional staking, you get liquid tokens instead of your coins, allowing you to continue trading while still earning rewards.